Forget the daily stock chart madness and the breathless cable news commentary. If you want the real, unfiltered story of how a company is actually doing, you need to go straight to the source: its quarterly earnings report.

Learning how to read one of these is probably the single most empowering skill you can develop as an investor. It’s not about finding one magic number; it’s about piecing together the complete narrative of a business's health, straight from the horse's mouth.

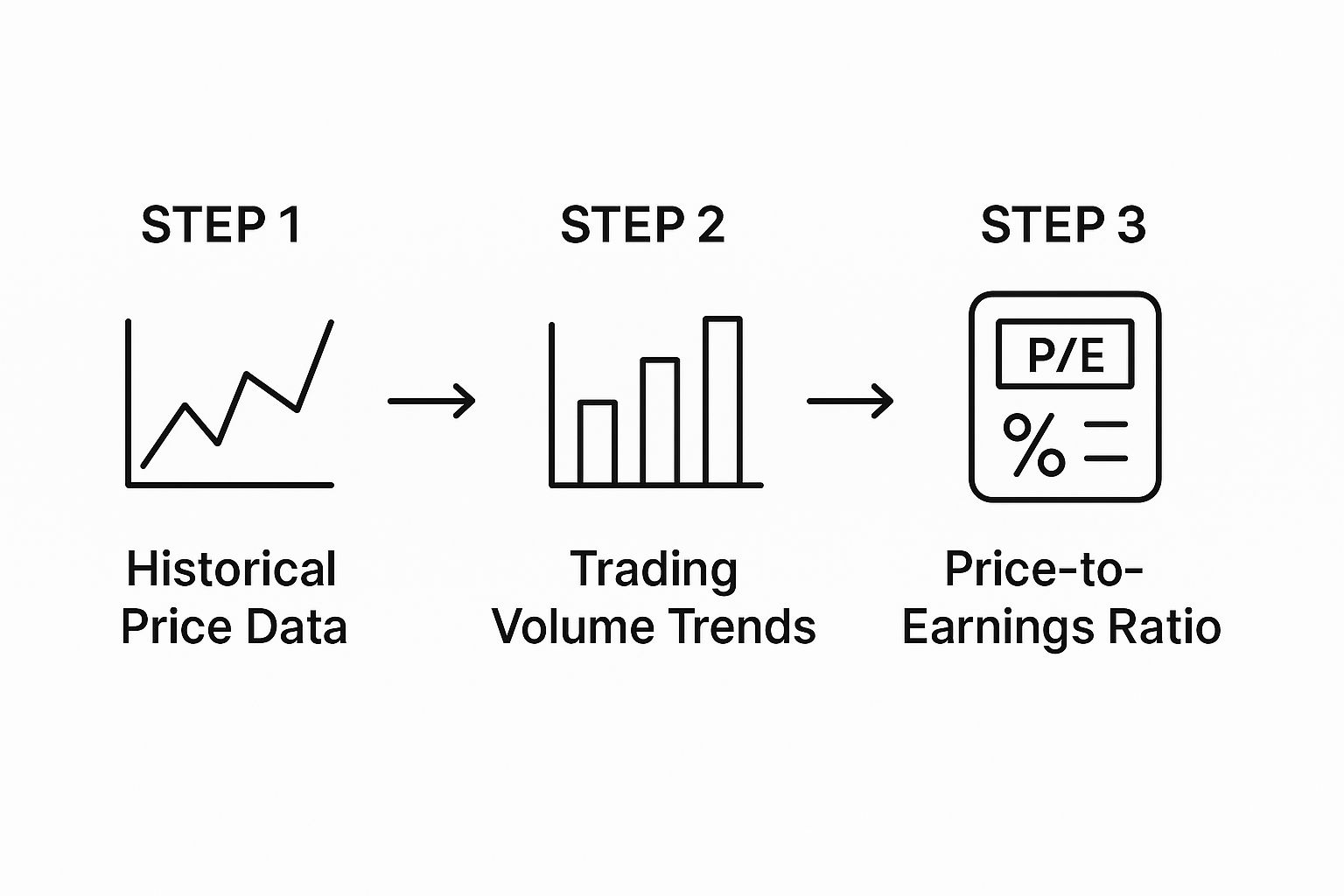

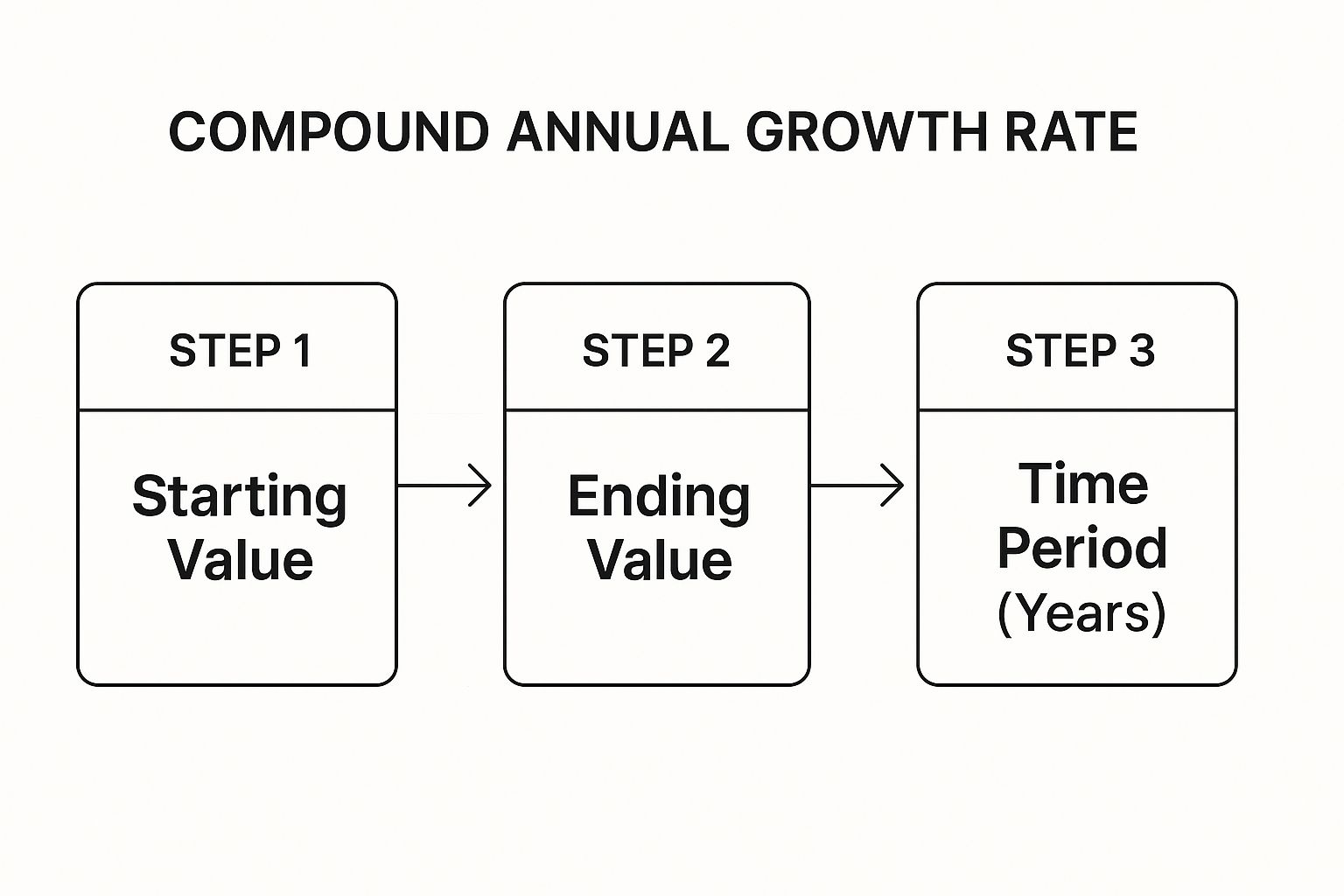

When you boil it all down, the entire process is about analyzing three critical documents that lay the financial foundation bare:

- The Income Statement: Shows you if the company is profitable over a specific period.

- The Balance Sheet: Gives you a snapshot of its assets and liabilities at a single point in time.

- The Cash Flow Statement: Tracks the actual cash moving in and out of the business.

Once you get the hang of these, you can confidently figure out a company’s true financial footing. This skill is also your ticket to understanding broader market trends. For instance, in a recent third quarter, S&P 500 companies were on track to report a year-over-year earnings growth rate of 7.6%. That marked the ninth straight quarter of growth. Seeing details like that, which you can dig into with resources like FactSet's earnings research, helps you spot durable trends instead of just chasing headlines.

Think of an earnings report as a company’s financial confession. Your job is to figure out if it's the whole truth or just a convenient version of it.

I'll be honest, these reports can be dense. They’re often released as long PDFs that are a pain to get through. If you're short on time, you might want to use AI tools to summarize PDF documents to pull out the key highlights before you dive in for a closer look.

This guide is your roadmap. We’ll walk through how to find any company's report, break down the key statements line by line, and—most importantly—learn how to read between the lines to see what management is really signaling about the future.

Your Quick Guide to Analyzing an Earnings Report

Before we get into the nitty-gritty, here’s a high-level look at what we'll be covering. This table breaks down the core components of an earnings report and the key questions each one helps you answer. Think of it as your cheat sheet.

| Component | What to Look For | Key Question It Answers |

|---|---|---|

| Income Statement | Revenue growth, gross margin, operating margin, net income, earnings per share (EPS) | "Is the company profitable and are its profits growing?" |

| Balance Sheet | Total assets, total liabilities, shareholder equity, debt levels (debt-to-equity) | "Is the company financially stable or is it drowning in debt?" |

| Cash Flow Statement | Cash from operations, cash from investing, cash from financing, free cash flow (FCF) | "Is the company generating real cash?" |

| Key Ratios | P/E ratio, P/S ratio, ROE, current ratio | "How is the company valued and how efficient is it?" |

| Management Commentary | Guidance for future quarters, tone of the conference call, reasons for performance | "What's the story behind the numbers and what's next?" |

By the time we’re done, you’ll be equipped to spot the red flags and opportunities that most retail investors completely miss. Let’s get started.

Unpacking the Income Statement Story

If you want to understand how a business really did over a quarter or a year, the income statement is where you start. Think of it as the company's report card. It tells a story, starting with every dollar that came in the door and ending with what was actually left in the bank. Getting comfortable reading this story is a non-negotiable skill for any serious investor.

This is a peek at the SEC's EDGAR database. It’s the official treasure chest where every public company files its reports. Don't be intimidated; it’s your primary source for the real numbers. You'll search for a company and then pull up their 10-Q (quarterly) or 10-K (annual) filing to find the income statement.

Starting at the Top Line: Revenue

The very first number you'll lay eyes on is Revenue, famously known as the "top line." This is the total haul from all sales during that period. But just seeing a big number here doesn't tell you much. The real insight comes from digging into the quality of that revenue.

Is it growing year-over-year? Is that growth picking up steam or starting to fizzle out? A business that's consistently cranking out 15% sales growth every year is a whole lot more interesting than one whose sales are all over the map.

Moving Down to Gross Profit and Margins

Next up, you subtract the Cost of Goods Sold (COGS) from the revenue. These are the direct costs tied to making the products or delivering the services. What's left over is the Gross Profit, and this little number is a huge tell. It shows you how efficiently the company makes what it sells.

From there, we can quickly calculate the Gross Margin (just divide Gross Profit by Revenue). A fat, steady gross margin tells you the company has serious pricing power and a good handle on its production costs. If you see that margin suddenly tank, it could be a warning sign of rising material costs or tough competition forcing them to slash prices.

Pro Tip: One of the most revealing things you can do is compare gross margins between direct competitors. A company that consistently boasts a higher gross margin than its peers often has a powerful competitive advantage—what many call a "moat."

Understanding Operating Expenses and True Profitability

After Gross Profit, the next section details the Operating Expenses. These are all the costs of keeping the lights on that aren't directly linked to producing a single item.

- Selling, General & Administrative (SG&A): This is a big bucket that holds everything from marketing campaigns and sales commissions to the CEO's salary and the rent on their fancy headquarters. If this number spikes without a similar jump in revenue, it might be a red flag for bloat or inefficiency.

- Research & Development (R&D): For any company in tech or pharma, this is the lifeblood—it's their investment in what's next. A company could cut its R&D budget to make the short-term profit numbers look good, but doing so could easily cripple their long-term ability to innovate and grow.

Once you subtract these expenses from the Gross Profit, you get the Operating Income. I love this metric. It gives you a clean, honest look at how profitable the company's core business is before things like interest payments and taxes start to muddy the picture. Many experienced investors I know consider it a more reliable measure of performance than the final net income.

Finally, after the company accounts for interest on its debt and pays Uncle Sam his cut, you land on Net Income—the one and only "bottom line." This is the figure that gets all the headlines because it's used to calculate one of the most-watched metrics in the market: Earnings Per Share (EPS). To really get a handle on this all-important number, take a look at our deep dive into what earnings per share means and why it has the power to move stocks.

Reading the Balance Sheet for Financial Stability

If the income statement is the story of a company's performance over a few months, the balance sheet is its financial x-ray. It gives you a powerful snapshot of a company’s health on one specific day, revealing exactly what it owns and what it owes. Getting a feel for this balance is critical when you're learning how to read earnings reports for long-term portfolio winners.

The whole thing hinges on one simple, almost elegant equation: Assets = Liabilities + Shareholders' Equity. It has to balance—hence the name. Let’s break down what each piece really tells you as an investor.

Assets and Liabilities: The Foundation of Financial Health

Assets are everything the company owns that has value. Think cash in the bank, inventory on the shelves, and property or equipment. On the other side of the ledger, Liabilities represent everything the company owes, from unpaid bills to suppliers to big bank loans.

A great first check is to compare current assets (stuff that can be turned into cash within a year) to current liabilities (bills due within a year). If current assets are comfortably larger than current liabilities, the company probably has enough cash on hand to cover its short-term bills without sweating. If not, it could be a red flag for a cash crunch down the road.

A strong balance sheet is like a fortress. It helps a company withstand unexpected recessions or attacks from competitors, giving it the flexibility to invest for the future even when things get tough.

Context here is everything. A car manufacturer, for instance, will have a balance sheet loaded with physical assets like factories and machinery. A nimble software company's biggest assets, on the other hand, might be intangible things like intellectual property, and it might have far fewer liabilities.

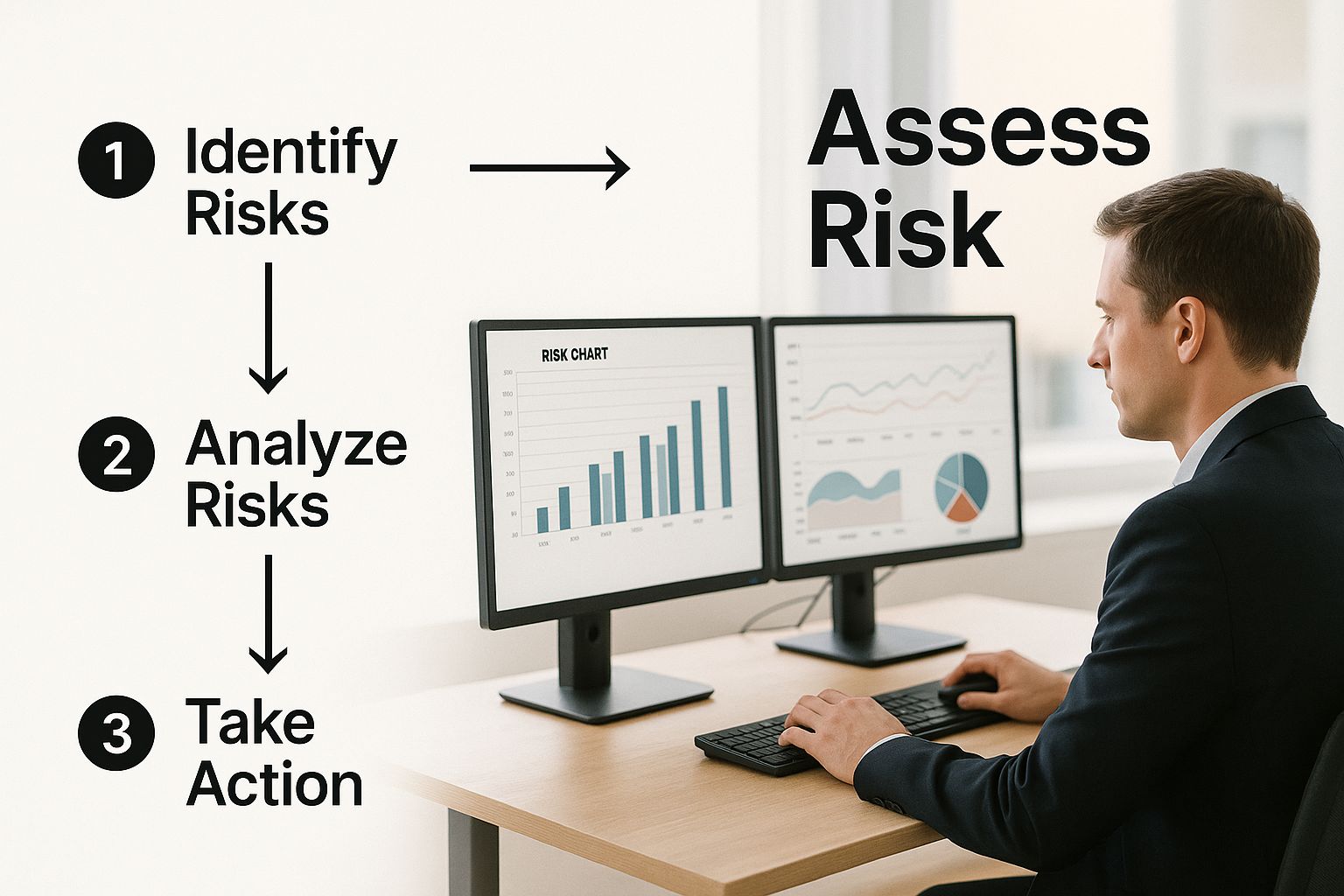

Gauging Long-Term Risk with Debt Ratios

Beyond the immediate picture, you need to look at long-term risk. My go-to tool for this is the debt-to-equity ratio. You get this number by dividing total liabilities by shareholders' equity. A high ratio tells you the company is using a lot of debt to fund its growth, which can get dicey if business slows down.

What's "high"? Well, it varies wildly by industry. A steady utility company can safely carry way more debt than a volatile tech startup. Always, always compare a company's ratio to its direct competitors to get a meaningful benchmark.

Looking at real-world numbers helps put this in perspective. For example, a giant like Costco Wholesale reported Q4 revenue of $85.84 billion, a nice jump from $79.7 billion the previous quarter. That kind of strong performance, along with growing earnings per share, points to a healthy financial position that will show up on its balance sheet. You can dig into real-time earnings data to find benchmarks for your own analysis.

Checking these details gives you concrete numbers to ground your evaluation. The balance sheet isn't just an accounting exercise; it’s a vital diagnostic tool that reveals a company’s true resilience.

Following the Cash for the Real Story

There's an old Wall Street saying every investor should have tattooed on their brain: "Profit is an opinion, but cash is a fact." It’s a classic for a reason.

While the income statement gives you a version of profitability shaped by accounting rules, the cash flow statement tells the unvarnished truth. It tracks the actual, physical cash moving in and out of the business. It’s the ultimate reality check.

A company can easily report a massive profit but be dangerously low on cash. This happens all the time. Accounting rules let businesses book revenue before a customer has even paid the bill. The cash flow statement cuts right through that noise, showing you if the business is truly generating the cash it needs to pay its bills, invest, and grow.

The Three Faucets of Cash Flow

To really get the picture, the statement is broken down into three distinct parts. Think of them like three faucets controlling the flow of money into and out of the company’s bank account.

-

Cash Flow from Operations (CFO): This is the big one. It’s the cash generated from the company's core business activities—selling widgets, providing services, whatever it is they do. A healthy, consistently growing CFO is the hallmark of a strong, sustainable business.

-

Cash Flow from Investing (CFI): This section tracks cash used for investments to grow the business for the long haul. It includes buying or selling assets like equipment, factories, or even other companies. Seeing a negative number here is often a good thing; it means the company is reinvesting in its future.

-

Cash Flow from Financing (CFF): Here’s where you see how a company raises money and pays it back. This includes activities like issuing or buying back stock, and taking on or paying down debt.

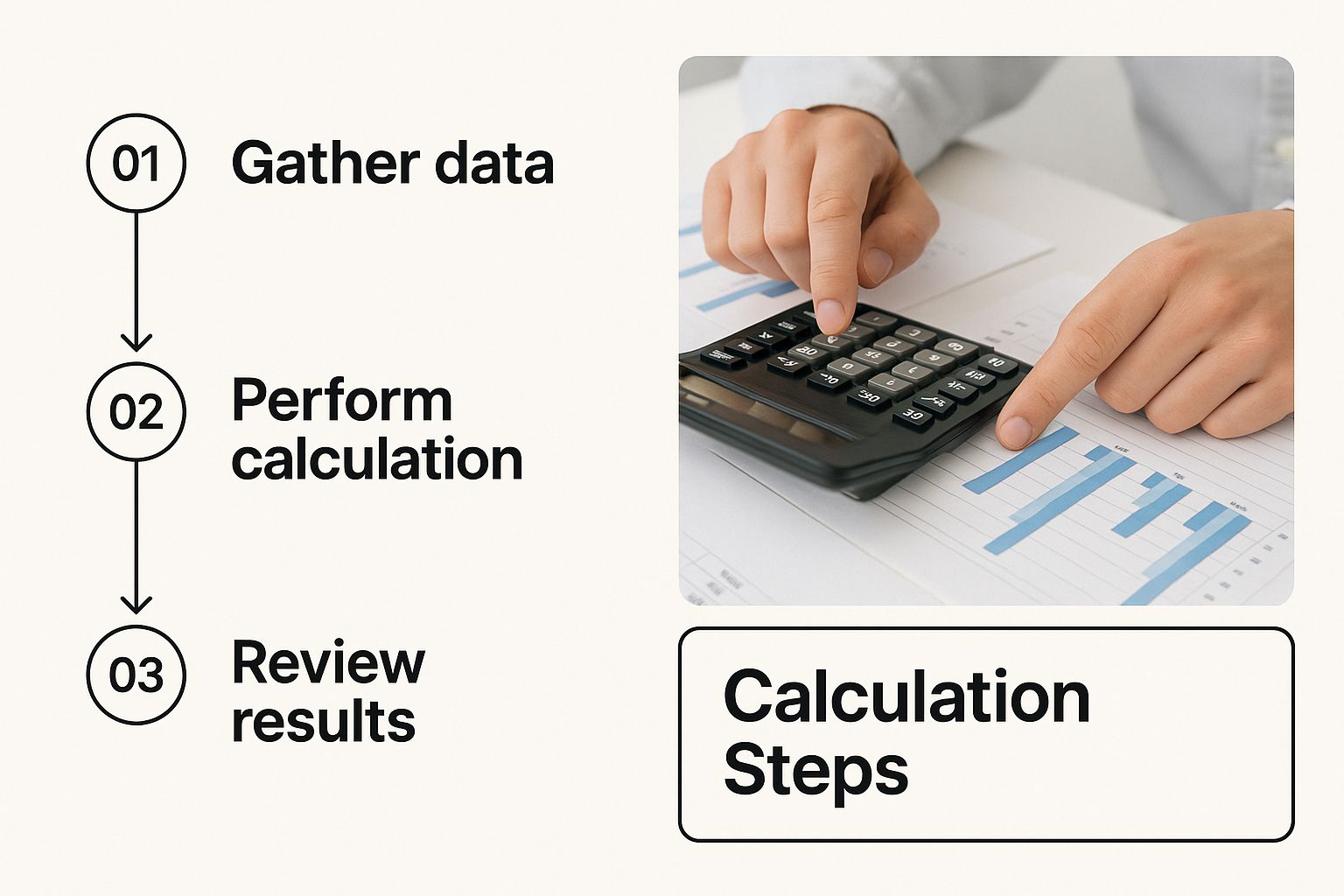

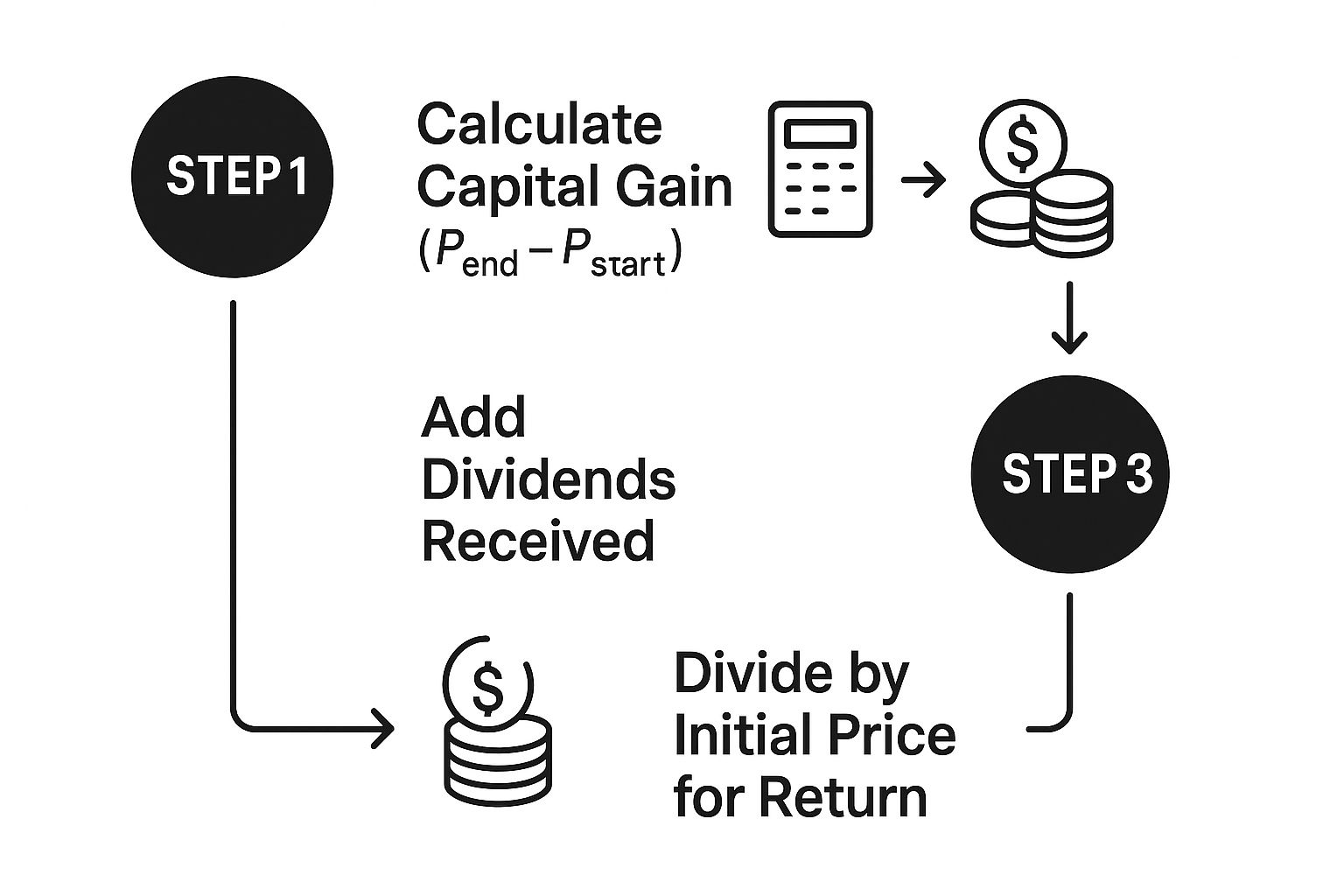

This simple infographic below shows how accountants get from the "profit" on the income statement to the "cash" from operations.

As you can see, the critical step is adding back non-cash expenses, like depreciation, to the net income figure. This gives you a much truer picture of how much cash the core business is actually spitting out.

Connecting the Dots for Deeper Insights

The real magic happens when you look at how these three sections interact with each other. A mature, healthy company might show a strong positive CFO, a negative CFI (from reinvesting in growth), and a negative CFF (from paying dividends or buying back stock).

A startup, on the other hand, might have a negative CFO but a positive CFF. This isn't necessarily bad; it just means it's burning cash to get off the ground and raising money from investors to fund that initial growth spurt.

What you don't want to see is a company with negative cash flow from operations that's staying afloat by constantly taking on new debt (positive CFF). That's an unsustainable model and a clear sign of trouble. Learning to spot these patterns is a key part of what cash flow analysis is all about and can help you sidestep some truly risky investments.

The table below breaks down a few common scenarios you'll encounter and what they might suggest about a company's health and strategy.

Interpreting Cash Flow Scenarios

| Operating Cash Flow | Investing Cash Flow | Financing Cash Flow | What It Could Mean |

|---|---|---|---|

| Positive (+) | Negative (-) | Negative (-) | Healthy & Mature: The company's core business is profitable, it's reinvesting for growth, and it's returning capital to shareholders. This is often the ideal scenario. |

| Positive (+) | Negative (-) | Positive (+) | Growing Company: Operations are funding growth, but it's also raising external capital (debt or equity) to expand even faster. Common for companies in a high-growth phase. |

| Negative (-) | Positive (+) | Positive (+) | Struggling or Restructuring: The core business is losing money. It's selling off assets and raising capital just to stay afloat. A potential red flag. |

| Positive (+) | Positive (+) | Negative (-) | Mature & Consolidating: The business is profitable and is also selling off assets (perhaps non-core divisions). The cash is being used to pay down debt or reward shareholders. |

| Negative (-) | Negative (-) | Positive (+) | Early-Stage Startup: Not yet profitable and investing heavily in its future. It's relying entirely on financing from investors to fund its operations and growth. |

Reading these combinations is like reading a story. It gives you incredible context that a single number from the income statement just can't provide.

A business that consistently generates more cash than it consumes is a business with options. It can invest, innovate, acquire competitors, or return capital to shareholders—all without asking permission from a bank. That's financial freedom, and you can only see it on the cash flow statement.

Going Beyond the Numbers for Deeper Insights

The financial statements lay out the hard facts, but they don't tell you the whole story. They show you what happened, but not why it happened or where the company is headed next.

To get that color, you need to dig into the narrative sections of the report and, most importantly, listen in on the investor conference call. This is where you get a real feel for management’s confidence and can sniff out risks that the spreadsheets might miss.

This qualitative analysis is a massive piece of the puzzle. The numbers give you a snapshot of the past, but it’s the commentary and future guidance that really move a stock's price.

Reading Between the Lines of Management Commentary

The Management's Discussion and Analysis (MD&A) section is where the executives get their chance to explain the company's performance. They'll break down what drove revenue, what squeezed their margins, and what they see as the big opportunities or threats on the horizon.

Pay close attention to the language they use here. Is it specific, or is it vague corporate-speak?

A CEO who says, "We saw a 15% increase in our enterprise segment thanks to strong demand for our new AI-powered analytics tool," is giving you a clear, confident reason for their success.

Compare that to a fuzzy statement like, "We faced macroeconomic headwinds that impacted cyclical demand patterns." While that might be true, it’s a dodge. It doesn't tell you much and avoids taking direct ownership. The best leadership teams own their results, good and bad.

Your job as an investor is to be a healthy skeptic. Treat overly rosy forecasts with caution and dig deeper when you hear vague excuses for poor performance. The story management tells should always line up with the numbers.

The Power of the Investor Conference Call

The investor conference call is where the real action happens. After reading their prepared remarks, the management team opens the floor to questions from Wall Street analysts. These analysts are sharp, they’ve done their homework, and they aren’t afraid to ask the tough questions that the report itself might gloss over.

Listening to these calls (or just reading the transcripts later) can be incredibly revealing. You can learn a ton from:

- Their Tone of Voice: Does the CEO sound confident and in command, or are they hesitant and defensive when a tough question comes up?

- The Specificity of Their Answers: When an analyst presses them on inventory levels, do they give a direct answer with data to back it up, or do they pivot to a different topic?

- The Questions Being Asked: If you hear three different analysts all asking about rising competition in a key market, that’s a huge red flag. It tells you exactly what the market is worried about and signals where you need to do more research.

These calls can be dense and honestly, a bit of a slog to get through. To pull out the key moments and analyst sentiment without listening to an hour-long recording, using free earnings call analysis tools can be a game-changer. This qualitative data is every bit as important as the numbers themselves.

Putting It All Together with Confidence

You’ve made it through the weeds. You've picked apart the income statement, balance sheet, and cash flow statement. You’ve even learned to read between the lines of the management team's commentary. Now comes the fun part: connecting all these threads into a story that actually helps you make smarter investment decisions.

This is where raw data turns into a real investment thesis. The goal isn’t to just tick boxes on each financial document. It’s about seeing how they all dance together.

For instance, did the income statement flash a massive jump in revenue? Awesome. But before you celebrate, pop over to the balance sheet. Did accounts receivable balloon by a similar amount? If so, the company isn't actually collecting cash—it's just booking sales on credit. That could be a serious red flag.

A Cohesive Analytical Framework

Think of your analysis as a series of reality checks. A single quarterly report is just one chapter in a much longer book, and you need context to make any sense of the plot. I’ve found the best way to do this is by looking at the numbers from three critical angles.

You have to compare the current quarter’s results against:

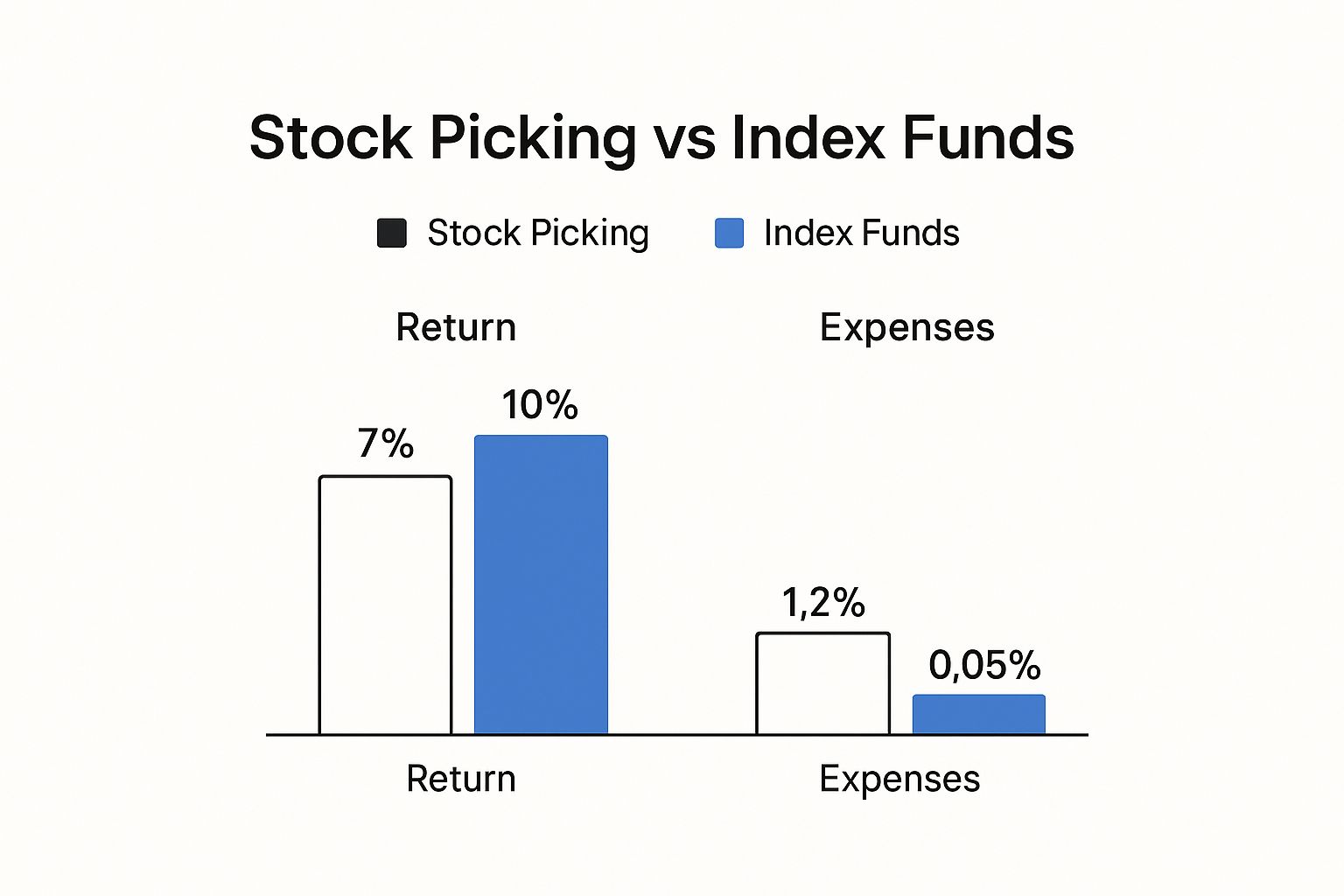

- Its Own History: Is the 8% revenue growth this quarter an acceleration from last year's 5%? Or is it a major slowdown from the 12% it posted just two quarters ago? Trends tell you so much more than a single data point ever could.

- Its Competitors: That 15% operating margin might look great on its own. But is it? It’s fantastic if its main rival only manages 10%, but it’s a big warning sign if the undisputed industry leader is consistently hitting 25%.

- Analysts' Expectations: Did the company beat, meet, or miss the consensus earnings per share (EPS) estimate? This is what drives the short-term stock pops and drops, but for long-term investors, the reason for the beat or miss is what really counts.

Building conviction isn’t about finding a perfect, flawless company. It's about knowing a company’s strengths and weaknesses so intimately that you can confidently hold onto your shares, even when the market starts to panic.

From Analysis to Actionable Insight

Let's walk through a quick example. Imagine a software company we'll call "Innovate Corp." Their latest report shows impressive revenue growth and solid cash flow from operations. Looks good so far. But a quick glance at the balance sheet reveals their debt-to-equity ratio has doubled over the past year.

On the earnings call, a sharp analyst picks up on this and asks about the rising debt. The CFO explains it was used to fund a strategic acquisition that will crack open a whole new market for them.

Suddenly, that single data point—the rising debt—is contextualized. It's not a sign of a struggling business, but a calculated bet on future growth.

This is exactly how you build a complete picture. Each financial statement gives you a clue, and the management commentary helps you assemble the puzzle. This holistic view is the foundation for figuring out if a stock is a good value, a process you can dig into deeper with these different stock valuation methods.

A Few Common Questions About Earnings Reports

Even after you get the hang of the main financial statements, some practical questions always seem to trip people up. That's a totally normal part of the learning curve. Let’s tackle some of the most common ones I hear to clear up any confusion and get you reading these reports with more confidence.

Where Do I Actually Find These Reports?

Your first and best stop should always be the company's own website. Look for a section called "Investor Relations" or "Investors." This is home base. They'll post the press release, the full SEC filing (the 10-Q for quarterly or 10-K for annual reports), and usually a helpful slide deck that summarizes the quarter.

Every one of these documents also has to be filed with the Securities and Exchange Commission (SEC). You can find them for free on the SEC's EDGAR database. Most good brokerage platforms and the major financial news sites will also link directly to them and provide summaries, which can be a nice time-saver.

What's the Big Deal with GAAP vs. Non-GAAP Earnings?

This is a massive point of confusion, and it's one you absolutely have to understand.

- GAAP (Generally Accepted Accounting Principles): Think of this as the official, standardized rulebook for accounting in the U.S. It’s designed to make sure numbers are calculated the same way from one company to the next, which allows for fair comparisons.

- Non-GAAP (or "Adjusted"): These are custom numbers a company creates by taking the official GAAP numbers and pulling out certain expenses. They argue these adjustments—often for things like one-time restructuring costs or stock-based compensation—give you a "cleaner" look at the core business.

Now, management isn't necessarily wrong. Sometimes these adjusted figures really do offer a better sense of day-to-day performance. But you have to approach them with a healthy dose of skepticism. Always, and I mean always, find the reconciliation table in the report. It shows you exactly what they're removing. Some companies get pretty creative here, and it can be a way to paint a much rosier picture than reality.

How Much Does an Earnings Beat or Miss Really Matter?

The whole "beat" or "miss" narrative—whether a company's earnings per share (EPS) came in above or below Wall Street's consensus estimate—is what drives 90% of the immediate, knee-jerk stock price reaction. It's the headline that grabs all the attention.

For a long-term investor, though, it’s just noise. The underlying business trends are what you should be focused on. Is revenue growth picking up speed? Are profit margins getting wider? Is the balance sheet getting stronger or are they piling on debt?

An earnings beat that comes from slashing the R&D budget is a whole different story than a beat driven by skyrocketing sales of a new product. The 'why' behind the number tells you infinitely more about the health of the business than the headline itself.

What Are the Biggest Red Flags to Watch For?

When you’re starting out, knowing what looks fishy is half the battle. A few warning signs should always make you slow down and dig a lot deeper:

- Consistently declining revenue or margins that are getting squeezed year after year.

- Negative cash flow from operations is a big one. It means the core business is actually burning through cash, not generating it.

- Debt levels that are ballooning, especially when you look at them next to their direct competitors.

- A huge buildup of unsold inventory just sitting on the balance sheet.

- Vague, evasive language from the CEO on the investor call. If they're dodging direct questions, there's usually a reason.

Spotting one of these doesn't automatically mean you hit the sell button, but it’s a bright, flashing light telling you to investigate further before you make your next move.

At Investogy, we cut through the noise by tying every analysis back to a real-money portfolio, showing you exactly how we interpret these reports to make actual investment decisions. Subscribe to our free weekly newsletter to see our research in action.

Subscribe to Investogy for free